how to lower property taxes in california

This video covers how property tax is calculated and how you can pay a lower overall property tax. Appeal the Taxable Value of Your Home.

The Property Tax Inheritance Exclusion

Now that you know what its like inside the assessors office here is how to lower your property tax bill.

. To lower your property taxes in a few clicks log in to DoNotPay and follow these steps. Monday to Friday Excluding Holidays Telephone 916 875-0700 8 am. Take these specific steps.

Access your DoNotPay account Open our Property Tax feature Provide the necessary answers Follow the instructions from our guide You will get all the necessary info in one place which will make the process super efficient. When you see an error in official records we can help expedite the process of lowering your property taxes. BUSINESS PERSONAL PROPERTY STATEMENTS DUE APRIL 1 2022 Avoid a 10 penalty by filing by May 9 2022 10 571-L penalty date of May 7th falls on a Saturday therefore date is moved to next business day May 9th.

Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. By the time you are already paying a certain amount its. Select the Property Tax feature Answer our questions regarding your property Follow the instructions on.

Option 1 Appeal The Taxable Value. Option 1 Appeal The Taxable Value In California the State Board of Equalization BOE oversees the local county assessors offices which determine the property taxes in their area. Appeal Your Assessment House on Dollar Bills.

Begin your appeal process by filing an Assessment Appeal Application Form BOE-305-AH which you can obtain from your county clerk or online. Begin your appeal process by filing an Assessment Appeal Application Form BOE-305-AH which you can obtain from your county clerk or online. There are a myriad of others.

To reduce your property taxes in a few clicks do the following. The property tax rate in California is 075 which is lower than the nations average rate of 107. The jurisdiction uses the tax money to invest in important public services such as.

Decline in Property Value Proposition 8 Since property taxes are calculated from the overall property value you should always try to have your property taxes lowered if the value of your property has declined. Now that you know what its like inside the assessors office here is how to lower your property tax bill. Mortgage Relief Program is Giving 3708 Back to Homeowners.

Although each county has its own method property taxes are generally. 1 Google assessors office Its important you proactively find out what the citycounty is assessing your property for first before you prepare for battle. In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value.

Failure To File Proposition 8 Appeal By September 15 Of Each Tax Year. Option 1 Appeal The Taxable Value. How Do I Reduce My Property Taxes.

California offers several property tax exemptions that can significantly reduce your annual property tax bill. The available exemptions are. Up to 25 cash back If you have questions or concerns that your local county assessor cannot answer you might wish to contact the BOEs Property Tax Department.

Some counties charge a 30 to 60 filing fee. Property taxes depend on two factorsyour homes assessed value and the countys property tax rate. California property owners are getting older.

Contact the California Franchise Tax Board at 1-800-868-4171 if you. There are however a few ways homeowners can reduce their California property taxes. So if your property is assessed at 300000 and.

The following are 10 ways to lower taxes that are frequently overlooked by even the most sophisticated California commercial property owner. The maximum income limitation for getting property tax assistance is 200000 per household if you are 62 blind disabled own and live in the home and qualify. Steps to Appeal Your California Property Tax.

Send the application to your assessors office with a return receipt requested. Simple Steps To Lower Your Property Taxes. Assistance for the hearing impaired is available by calling 711 for California Relay Service.

Who Qualifies For Property Tax Exemption California. In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value. To learn more about your options when inheriting a home from parents transferring their low property tax base to your new primary residence contact Michael Wyatt Consulting or the Commercial Loan Corp at 877 464-1066 to speak with a Trust Loan or Property Tax Savings specialist.

How Can I Lower My Property Taxes In California. Homeowners property tax exemption Senior tax exemption Veterans property tax exemption and disabled. There are however a few ways homeowners can reduce their California property taxes.

Check Your Eligibility Today. Claim All Tax Breaks to Which Youre Entitled Beyond reducing the taxable value of your home California allows for exemptions from property taxes if you meet certain requirements. Failure To File Proposition 8 Appeal By September 15 Of Each Tax Year.

ASSESSMENT INFORMATION Christina Wynn Assessor 3636 AMERICAN RIVER DRIVE SUITE 200 SACRAMENTO CA 95864-5952 Office Hours 8 am. There are however a few ways homeowners can reduce their California property taxes. Learn More Real Estate Toolkit Annual Report Homeowners Exemption New Construction Disaster Relief Decline-in-Value.

In California the State Board of Equalization BOE oversees the local county assessors offices which determine the property taxes in their area.

Property Taxes By State Embrace Higher Property Taxes

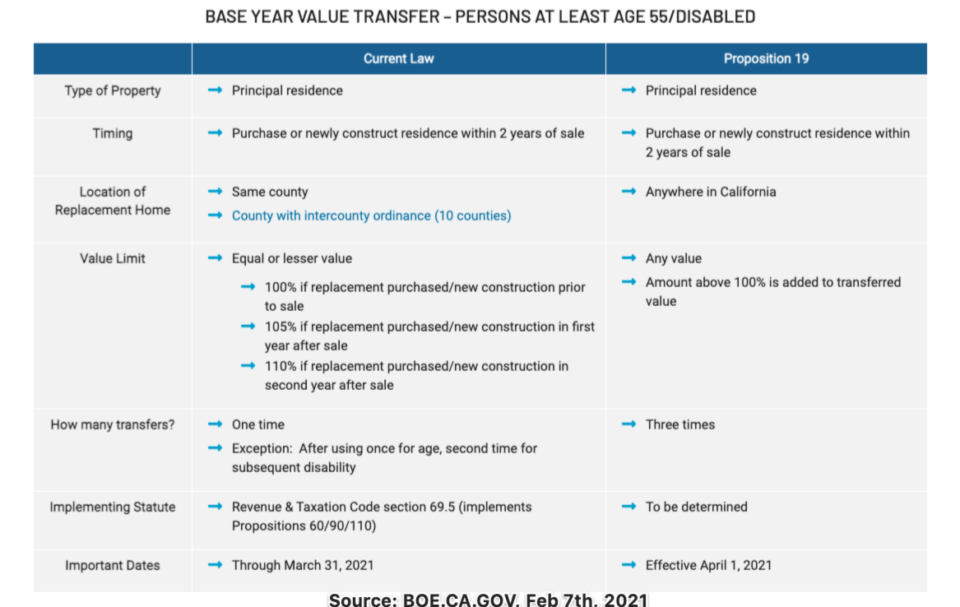

Prop 19 Would Make Changes To California S Residential Property Tax System California Budget And Policy Center

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

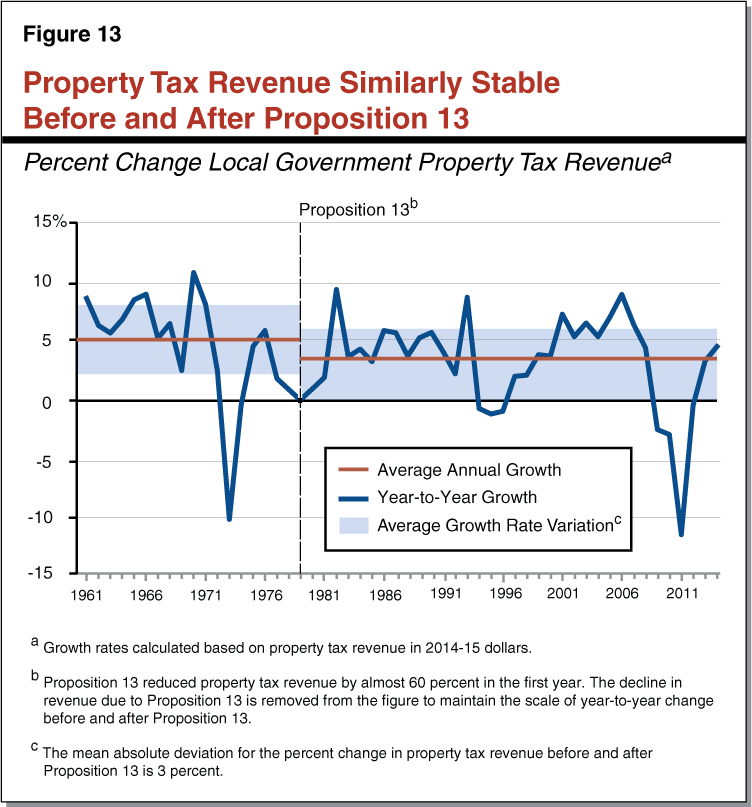

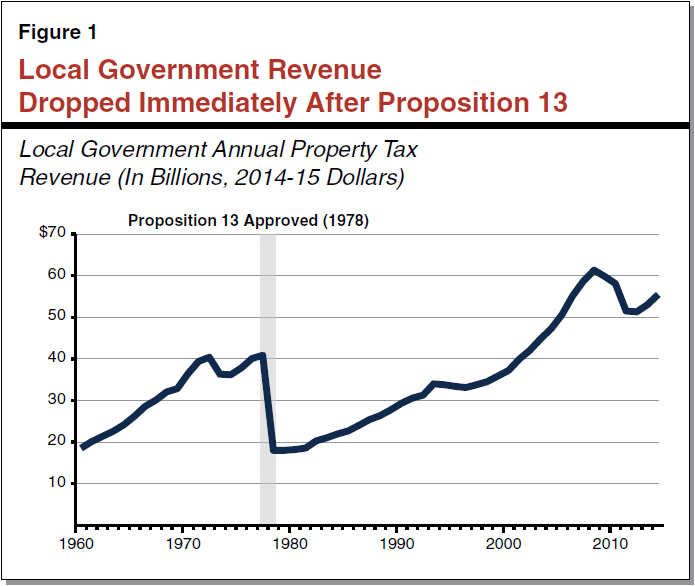

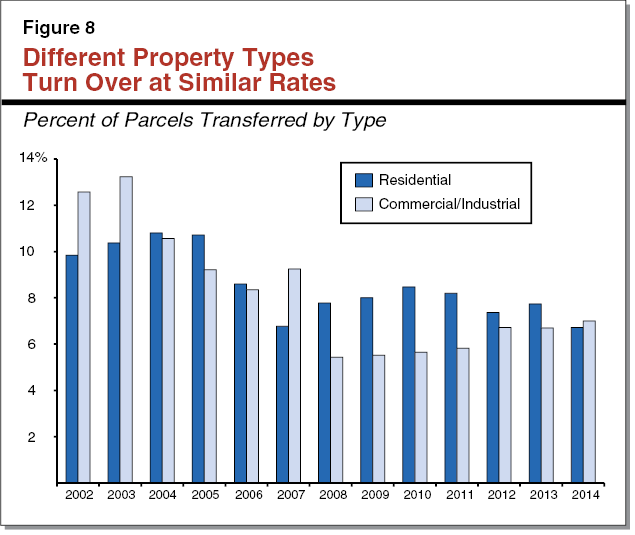

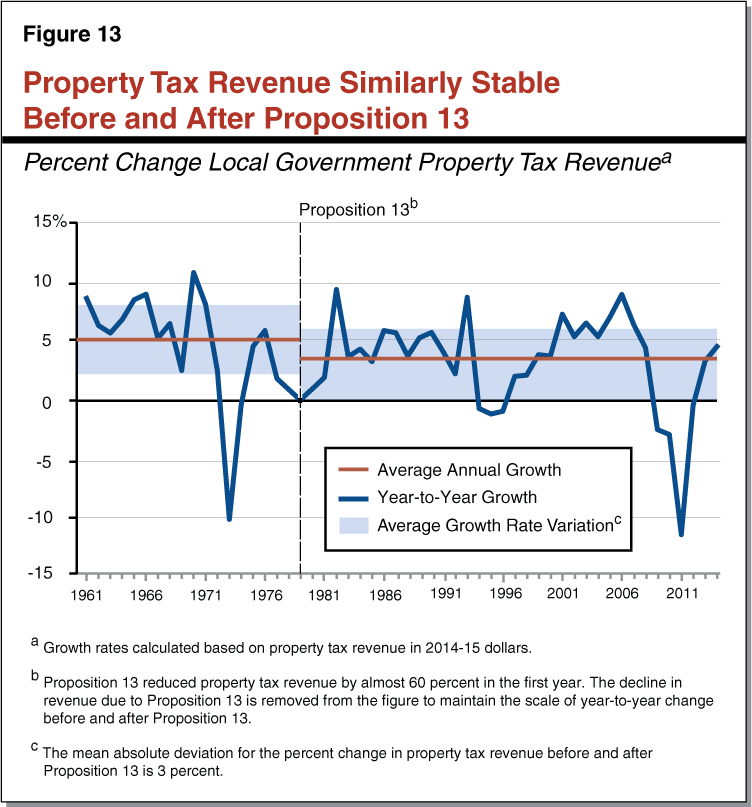

Common Claims About Proposition 13

Common Claims About Proposition 13

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

What Is A Homestead Exemption And How Does It Work Lendingtree

Deducting Property Taxes H R Block

Property Taxes By State Embrace Higher Property Taxes

Prop 19 Would Make Changes To California S Residential Property Tax System California Budget And Policy Center

Common Claims About Proposition 13

Payment Activity Notice Los Angeles County Property Tax Portal

Prop 19 And Property Taxes In California Marc Lyman

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center